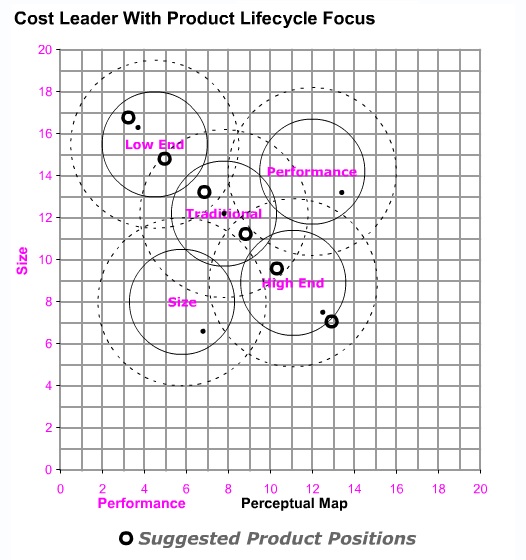

12.5 Cost Leader with Product Lifecycle Focus

A Cost Leader with a Product Lifecycle Focus centers on the High End, Traditional and Low End segments. The company will gain a competitive advantage by keeping R&D, production and material costs to a minimum, enabling it to compete on the basis of price. The Product Lifecycle Focus will allow the company to reap sales for many years on each new product introduced into the High End segment. Products will begin their lives in the High End, mature into Traditional and finish as Low End products.

Mission Statement

Reliable products for mainstream customers: Our brands offer value. Our stakeholders are bondholders, stockholders, customers and management.

Tactics

Research & Development: We will introduce a new High End product every two years. We will reposition our Low End product before it becomes obsolete (falls outside the Low End segment circle). We will reposition our Performance and Size segment products into our targeted segments. We will ultimately have a steady stream of products lined up along the High End, Traditional, and Low End segments.

Marketing: Initially we will attempt to keep pace with the awareness and accessibility of our competitors’ products. After we establish our cost leadership position we will revisit our situation to decide whether sales and promotion budgets should be reduced or if we should continue to match our competitors. Our prices will be lower than average.

Production: We will significantly increase automation levels on products we intend to keep for more than three years (Traditional & Low End) and spend the money necessary to set up highly automated plants for our new products as they are launched. We will sell off the plants for the Size & Performance products over the next few years.

Finance: We will Finance our investments primarily through long-term bond issues, supplementing with stock offerings on an as needed basis. When our cash position allows, we will establish a dividend policy and begin to retire stock. We are not adverse to leverage, and expect to keep assets/equity between 2.0 and 3.0.